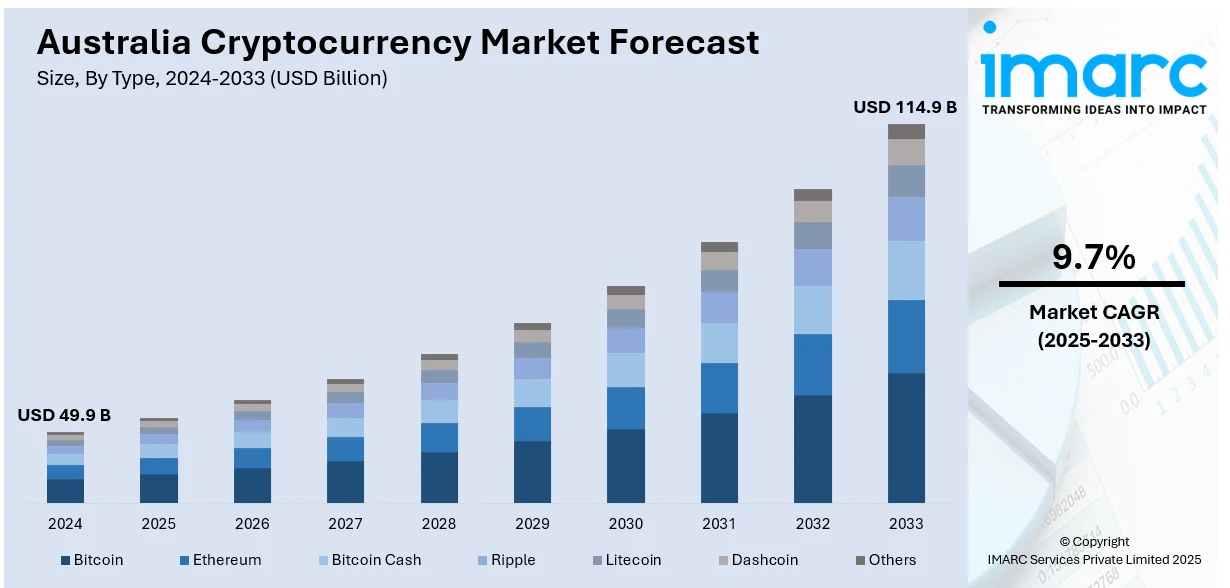

Australian Crypto Market Forecast 2024-2033 – Growing at a Bonzer 9.7% CAGR!

Why Passive Crypto is Your Ace in the Hole for 2025 Gains – Zero Hassle, Max Rewards

Passive income in crypto? It's like having a money tree in your backyard, mate – plant it once, and watch the fruits roll in. In Australia 2025, we're talking staking, lending, and yield farming on legit platforms. The market's booming: IMARC Group reckons it'll hit USD 114.9 billion by 2033, with a 9.7% CAGR from 2025 onwards. That's more growth than a vegemite sandwich fuels a footy player! But here's the USP: low effort, high potential yields (up to 10-20% APY on stablecoins), and it's all compliant with ATO rules – no nasty tax surprises if you hold over 12 months for that 50% CGT discount.

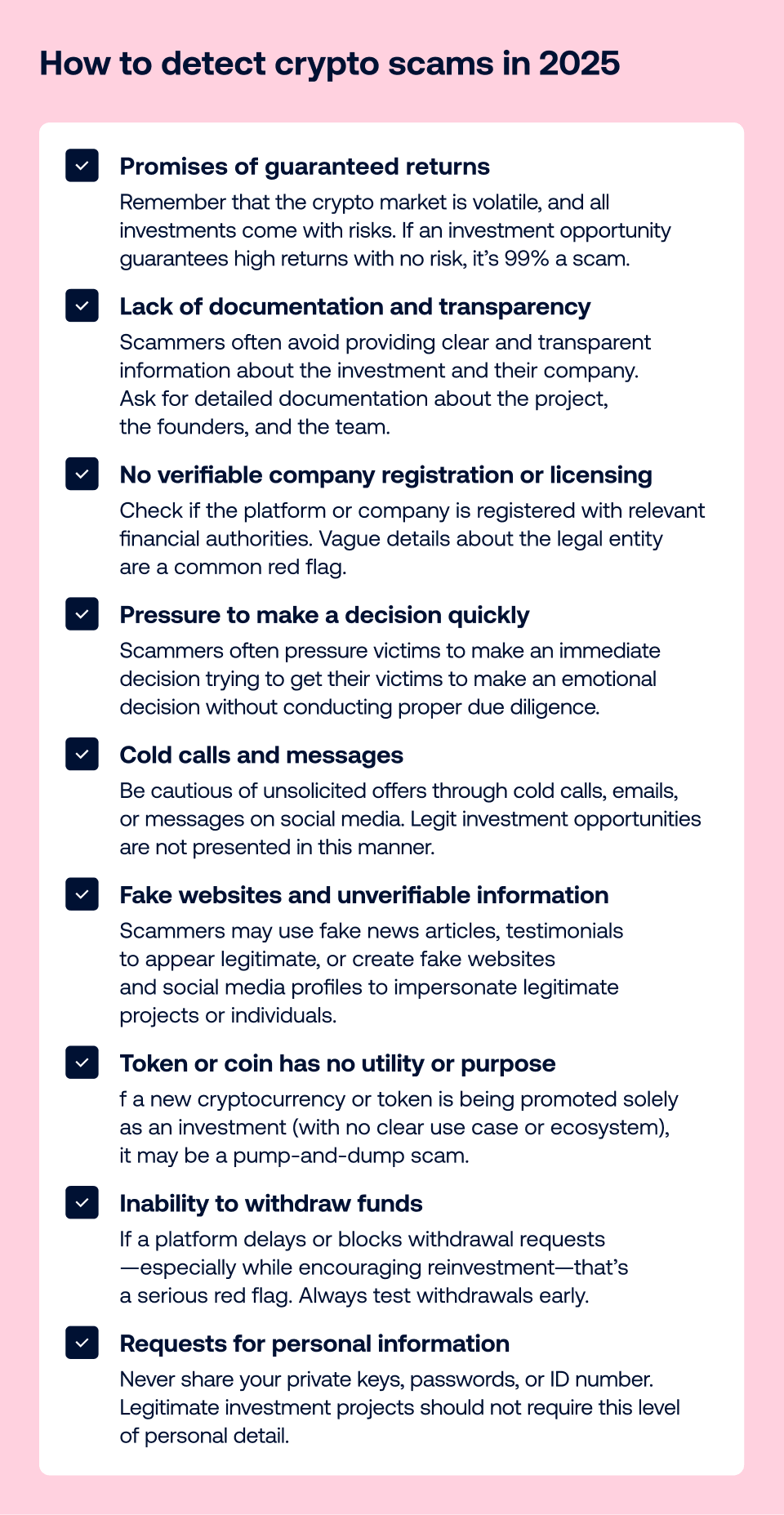

Dodge the Dodgy Platforms – Our USP: Scam-Proof Picks Only

Crikey, those platforms you mentioned? Quantum AI, Optima Fundrelix, Cryptoflux69, and the rest like Quantum BitQZ, InvestProAi, Anchor Gainlux – they're about as legit as a three-dollar note. From my digs into 2025 reviews, sites like cryptolegal.uk list 'em in their scam databases, with punters reporting blocked withdrawals and fake AI trading bots. Trustpilot gives Quantum AI a lousy 2.5/5, full of yarns about lost dosh. The FMA and WA's DFI are warning about similar frauds – they promise guaranteed returns but deliver zilch. Joke's on them: why trust a "Quantum" anything when quantum physics itself is unpredictable? Stick to regulated Aussie exchanges like Independent Reserve or Swyftx for real passive plays. That's our USP: safety first, so you don't end up flat broke like a kangaroo in a drought.

How to Spot Crypto Scams in 2025 – Red Flags Galore!

2025 Market Analytics – Riding the Wave Without Getting Dumped

Let's crunch the numbers, shall we? In 2025, Aussie crypto adoption's up to 31%, up from 28% last year – that's more folks than watch the State of Origin! Bitcoin and Ethereum dominate, but passive earners are eyeing stablecoins for steady yields. ATO's cracking down: crypto's treated as property, so staking rewards are income tax (up to 45% bracket), but long holds get that sweet 50% CGT cut. Analytics show average passive APYs: 5-8% on ETH staking, 10%+ on DeFi lending via Aave or Compound (but watch the volatility – it's wilder than a bucking bronco). Projection for 2025: with global crypto market recovery post-2024 dip, passive returns could average 12% annualized for diversified portfolios. But fair dinkum, diversify or die – don't put all your eggs in one crypto basket, or you'll be crying into your flat white.

Aussie Crypto Adoption Trends 2019-2025 – Up to 31% in 2025!

Comparison Table: Dodgy vs. Bonzer Platforms for Passive Crypto in 2025

Here's a ripper table comparing those suspect platforms to legit Aussie options. Based on 2025 reviews and regs – remember, the scam ones are red-flagged everywhere.

| Platform/Type | Legitimacy (2025 Reviews) | Passive Methods | Avg. Yield (2025 Est.) | Risks | USP for Aussies |

|---|---|---|---|---|---|

| Quantum AI & Similar (e.g., Cryptoflux69, Horizon AI) | Scam – Blocked withdrawals, fake AI bots | Fake auto-trading | Promised 100%+, actual 0% | High – Total loss | None – Avoid like the plague! |

| Optima Fundrelix, Blackrose Finbitnex, etc. | Reported scams per cryptolegal.uk | Phony investments | Unrealistic guarantees | Extreme – Fraud alerts from FMA | Zilch – Joke: Faster way to lose money than betting on the Melbourne Cup underdog. |

| Independent Reserve (Legit AU Exchange) | High – Regulated by AUSTRAC | Staking, Interest Accounts | 5-10% APY on BTC/ETH | Low – Secure, insured | Tax-compliant, OTC for big punters – Fair dinkum local hero. |

| Swyftx or Binance AU | Solid – ATO-friendly | Lending, Yield Farming | 8-15% on stablecoins | Medium – Market volatility | Easy fiat on-ramps, no foreign exchange fees – USP: Quick as a flash for passive setup. |

| DeFi Protocols (e.g., Aave via Wallet) | Variable – Use audited ones | Yield Farming, Lending | 10-20% variable | High – Smart contract risks | Decentralized freedom – But crikey, DYOR or you'll cop it sweet. |

Top Strategies for Passive Crypto Success in Australia 2025 – Our USP: Smart, Sustainable Plays

Righto, here's the drum on strategies – no get-rich-quick rubbish, just solid advice to build your crypto nest egg.

- Staking Smarts: Lock up ETH or ADA on a legit platform like Kraken AU. USP: Earn 4-7% rewards while securing the network. Tip: Hold over 12 months for CGT discount – that's half your tax bill gone, mate!

- Lending Like a Boss: Chuck stablecoins into Celsius or similar (but check 2025 regs – avoid offshore iffy ones). Yields up to 12%, but watch for defaults. Joke: It's like lending your ute to a mate – make sure they bring it back!

- Yield Farming for the Brave: Pool liquidity on Uniswap via an Aussie wallet. High returns (15%+), but impermanent loss can bite. Strategy: Start small, diversify pairs.

- Tax Tactics: Report everything to ATO by Oct 31, 2025. Personal use under $10k? CGT exempt. Pro tip: Use Koinly for tracking – saves you from a tax headache bigger than a hangover after the races.

- Risk Management Ripper: Diversify across 5-10 assets, use hardware wallets, and never invest more than you can afford to lose. In 2025, with ASIC tightening regs, stick to AU-licensed spots to avoid the coppers.

6 Ways to Generate Crypto Passive Income – Pick Your Poison!

There you have it, legends – passive crypto in Oz 2025 is a beaut opportunity, but steer clear of those scam platforms or you'll be up the creek without a paddle. If you've got questions, hit me up. Cheers!